No regulation leaves us in a messy place

Happy Holidays from all of us here at COMPETE! As the cycle starts to heat up, we have been getting a lot of questions from our clients about political ad transparency. What can we track? What can’t we track? What can we kinda, sorta track? Especially confusing for folks is why some television media can be tracked (Broadcast and Cable), and some can’t (all of non-Youtube Streaming). Since there is perfectly understandable widespread confusion on this, and we recently threw our hat in the ring to be a leading a voice on all things integrated media planning across TV, Streaming, and Digital, we thought we could give the Holiday gift of sharing our political ad transparency memo with all of you. We know it’s what everyone desperately wanted. You’re welcome. 🧑🎄🎁

TLDR – it’s a total mess. This is what you get when one of our major political parties isn’t interested in any federal regulation of, well, just about anything. Ho ho ho.

COMPETE Memo on Political Advertising Disclosure for Digital and Streaming TV Platforms

Key Points:

- Broadcast, Cable and Radio are required by Federal Law to disclose political spending in a public file that contains the details of every political buy.

- There is no Federal Law requiring Digital advertising companies to disclose political spending. This lack of regulation applies to advertising across all forms of Digital media: Streaming TV, Social Media, the internet, Digital radio, podcasts, influencer marketing, etc.

- Therefore, the only disclosure of Digital political spending that is available to the public is what Digital companies VOLUNTARILY make available. The rest is in a black box where we must rely on still-nascent technologies to get even a partial picture(1).

The Result:

- We estimate that less than 10% of Digital companies and their platforms voluntarily provide any information about Digital political spending (although the ones that have include Meta and Google, which command large market shares).

- The Digital companies that do provide voluntary information about Digital spending are under no legal requirement to report accurately, in a timely fashion, or with complete information.

- Therefore, the limited information we do receive voluntarily from the Digital companies is often incomplete, inaccurate, and varies in format from platform to platform.

- There is a desperate need to regulate the Digital industry. Digital companies could influence the outcome of elections by manipulating pricing for different candidates, or by allowing only their favored candidates access to inventory. There would be no way for anyone outside of the Digital companies to know if this was happening because there is no regulation forcing public reporting of political spending. This becomes an acute problem as more of the media ecosystem migrates towards offering ads through these unregulated Digital style ad auctions. A larger share of total media buys are deployed on black box platforms, without legal requirements for either a) transparency, or b) the companies to provide a fair playing field to all candidates.

- Nielsen’s the Gauge shows just how much TV style media has moved towards Streaming providers that, with the exception of Youtube Main(2), do not offer transparency. All other kinds of political media (Social Media, the internet, etc.) are entirely unregulated at the Federal level.

- Article on the nuts and bolts of Digital advertising buying mechanics

Read further for a more detailed explanation:

The “Self-Regulation” Status Quo

In the absence of any federal regulation pertaining to Digital ads, StreamingTV ads, or anything else bought through Programmatic Ad Auctions, a “self-regulation” status quo has evolved. As such, much of the landscape is a black box, and we are forced to estimate total ad buy sizes based on partial information available in the imperfect political ad libraries for just a few platforms that have created self-imposed transparency(1).

Which Platforms Offer Political Ad Transparency, Which Do Not, and Why?

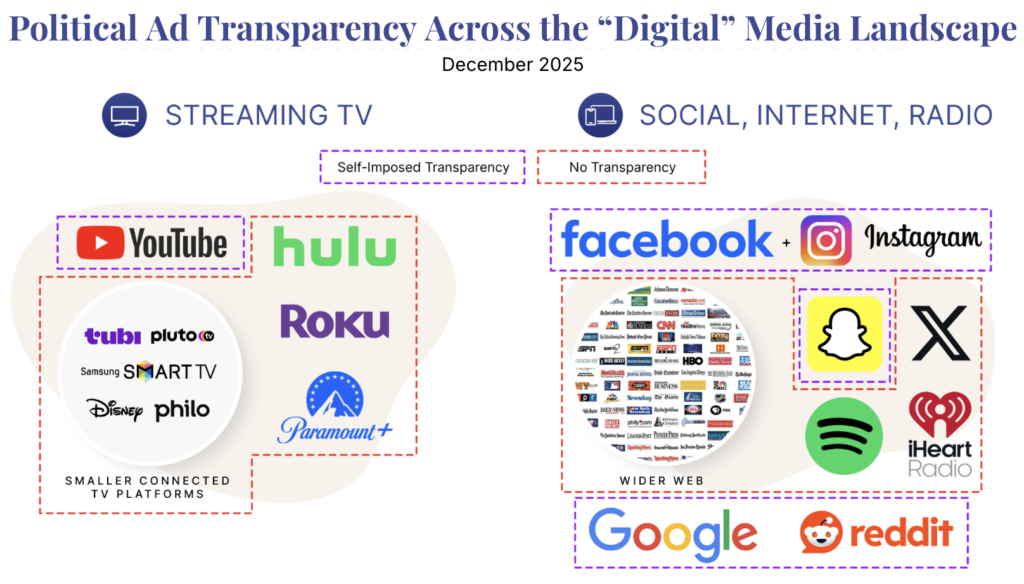

Many older, well known Digital companies have created their own ad certification + transparency libraries. These platforms are concerned about regulation + having their CEOs hauled in front of Congress for a good old-fashioned grilling, so they have tried to preempt these outcomes with a modicum of transparency and certification requirements for political entities wishing to advertise. Platforms with transparency / certification include Meta (Facebook and Instagram), Google (Youtube, Google Display, Google Search), Twitter / X (although it presently does not provide transparency for the U.S.), Reddit, and Snapchat.

Twitter / X Library (currently no U.S. Option)

Snapchat Library (must download a report)

Generally, platforms without significant market shares (Truth Social, Pandora) or that are newer (like Disney and Roku), as well as “Demand Side Platforms(3) (which, despite the large role they play in the ecosystem, benefit from Congress lacking understanding of how they work, and therefore Congress has not hauled / threatened to haul their CEOs up on Capitol Hill for a good old-fashioned grilling) have not felt the need to self-regulate in this manner. Since Donald Trump’s election, Digital and Streaming TV ad platforms have shown even less interest in self-regulating transparency. Platforms like X have garbage binned their transparency libraries in the U.S (no surprise given the general trend over there). Newer Streaming TV ad platforms like Disney Ads Manager and Roku Ads Manager with large market shares have, as of this writing, chosen not to build the kind of political transparency libraries that they might otherwise have felt pressure to build under a different administration. This has left a huge hole in the Digital media ecosystem with, by our estimation, only 30-40% of budgets we will deploy on fully funded, all platform campaigns offering any kind of transparency on political advertising. Stuff outlined in purple below has public transparency, other stuff does not.

Almost all ad platforms do require a paid for statement (even if it isn’t verified in a meaningful way by the platform, or is allowed to be tiny and illegible).

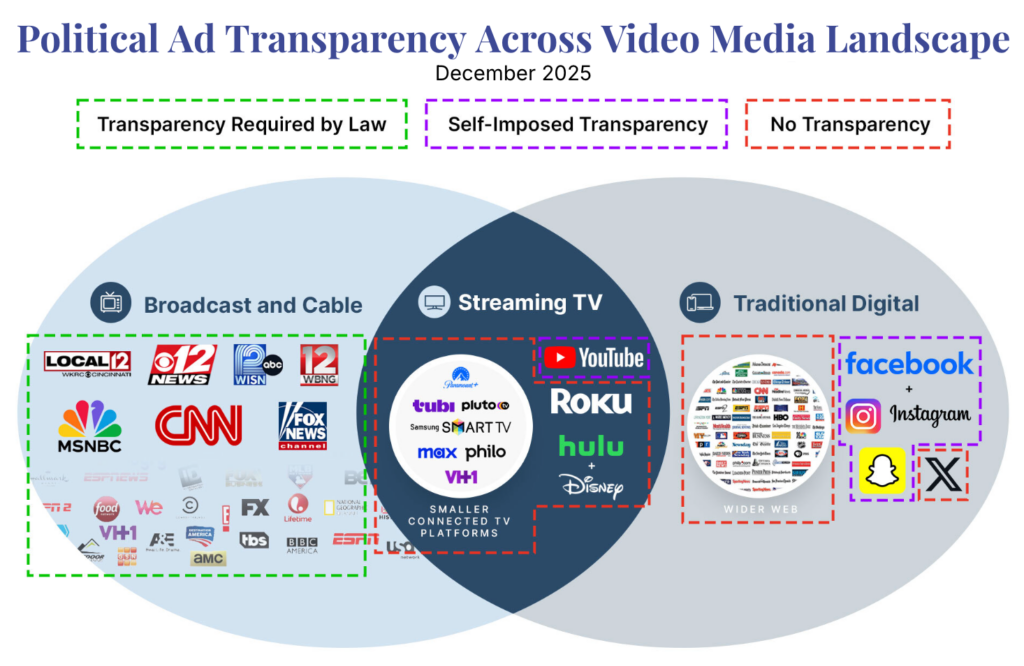

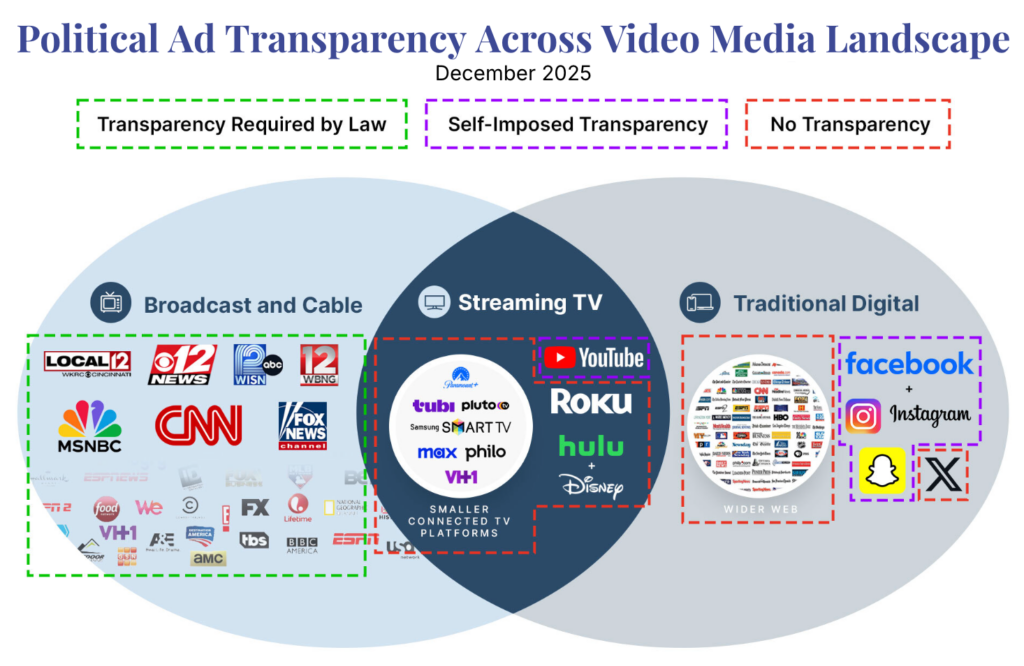

Zooming out and pivoting to a full picture of the video media landscape, including traditional television,we see that a significant amount of video advertising now happens on black box platforms without any political ad spend transparency.

No matter how you slice the media landscape, it is clear that there has been a marked decline in how much political spending can be accurately captured and quantified(3).

Further Complications and Definitions

(1) Better competitive tracking technologies are being developed. There are some emerging tools (AdImpact, AdHawk) that attempt to track Digital spending outside of the self-reported platforms, including Streaming TV ads. Since there is no federal regulation of digital or Streaming TV ad spending, these tools must rely on a combination of monitoring via panels, automatic content recognition, and CPM models to reach estimated spend totals for any given campaign. This methodology is still in a nascent phase and numbers should be taken as directional guidance rather than hard facts. As Streaming TV spending continues to make up a larger portion of digital ad buys, we expect to see more tools developed to track spending—or at least attempt to. Without federal laws requiring companies to divulge complete information, we fear these technologies will always provide an incomplete picture of the competitive landscape (although we would love to be convinced otherwise by one of these technologies and will update our priors if we are!).

(2) Demand Side Platforms (DSPs) knit together hundreds of thousands of suppliers across the Wider Web and Streaming TV into ad platforms through which advertisers can target their audiences (for a fee, of course!). DSPs, for the most part, don’t own the supply that is available in their platforms (in contrast to the “Walled Garden” supplier-owned ad platforms like Meta Ads or Google Ads). Some of the larger DSP brands are The Trade Desk, StackAdapt, and Basis. Learn more about all of this here.

(3) Youtube “Main” versus Youtube TV. There is some more understandable confusion created by Live Streaming Apps, like Youtube TV and Hulu Live, which tap into the Linear feed (ie. Broadcast or Cable) and can lead to different transparency outcomes for media within the same overarching brand. If someone is viewing a Linear feed through one of these apps, they may well see an ad that is subject to Federal regulation around political transparency, and that could be tracked in the manner that Linear competitive has been tracked for decades. But YouTube also (and primarily) sells ads through Digital style ad auctions on very similar channels to those on Youtube TV that are NOT subject to Federal Law and only reported as Digital Spend and not in the Broadcast, Cable or Radio public files. Nielsen calls this type of Youtube consumption “Youtube Main”, which is a large and growing chunk of TV style media consumption. If you think all of this is confusing, you are not alone. The media landscape is a rapidly changing mess right now that can be difficult to keep up with, with tech giants offering their media through different platforms and different methodologies – some subject to political spending regulation, and some not.

Put a bow on it.

Got questions for us? Or disagree with our analysis? Or perhaps you’ve got some fantastic software that can shine light into the non-disclosing platform black box? Please reach out to me and try to cheer me up about all of this. The lack of transparency on huge swaths of media that can influence elections is ripe for exploitation. Given who our President is, and how he has been trying to put Tech company owners under his thumb, that is a very scary proposition.

Sorry if that bums you out ahead of the Holidays.

Zach Mandelblatt

President

Zach@CompeteEverywhere.com