These 2 streaming behemoths now have their own ad platforms – how will it change media buying for the 2024 General?

Roku and Hulu, two of the biggest CTV providers in the media ecosystem, have rolled out their own Programmatic Ad Auctions. This change gives media buyers wholesale pricing and improved targeting options for reaching the ever-growing audience of American cord-cutters, and comes at an ideal time for political advertisers looking to the 2024 General Election. Swing voter media consumption habits are rapidly moving towards streaming providers, with recent reports finding that 63% of voters (and 70% of Independents) now prefer streaming over traditional TV. It also follows the general trend of media suppliers moving away from the Linear ad buying model towards Real-Time Programmatic Ad Auctions.

In our minds, Roku and Hulu launching their own ad auctions represents a seismic change in how to reach audiences with TV-style Media, simply because of the potential reach of these two companies. Approximately 12 million American households have a Roku device. Hulu’s ad platform is evolving into the Disney Campaign Manager, which will aggregate buying all of Disney’s sprawling holdings – Disney, Hulu, ESPN, ABC, Discovery, and more – in a single place. We estimate that as much as 10% of all TV-style media consumers will be reachable through channels and brands serviced by one of these two ad platforms.

In this article, we will break down the strengths and weaknesses of the two new ad auctions, their targeting capabilities, and how COMPETE is adapting our strategies and buying tactics for this evolution in the media landscape.

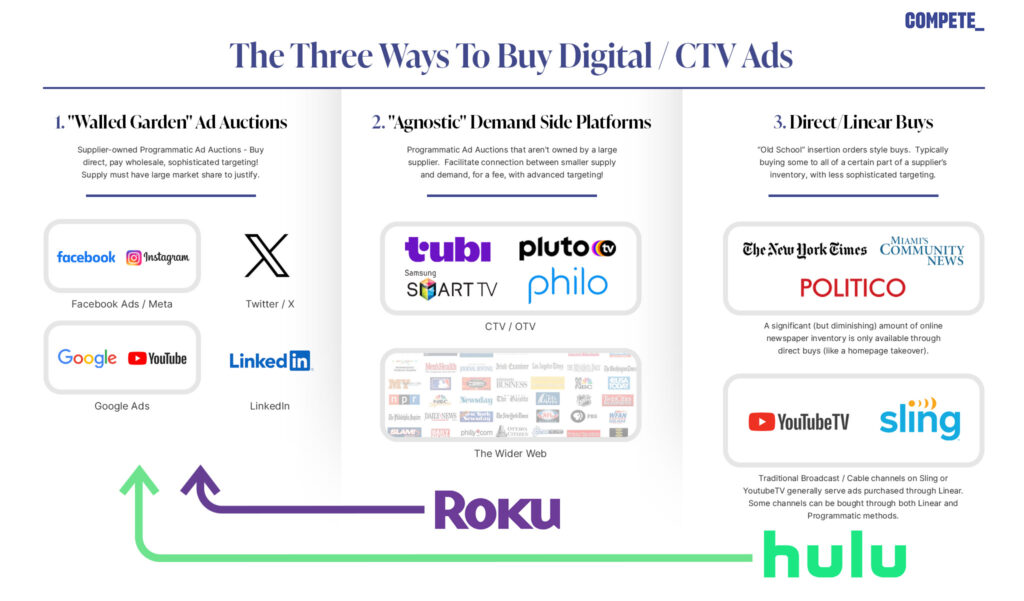

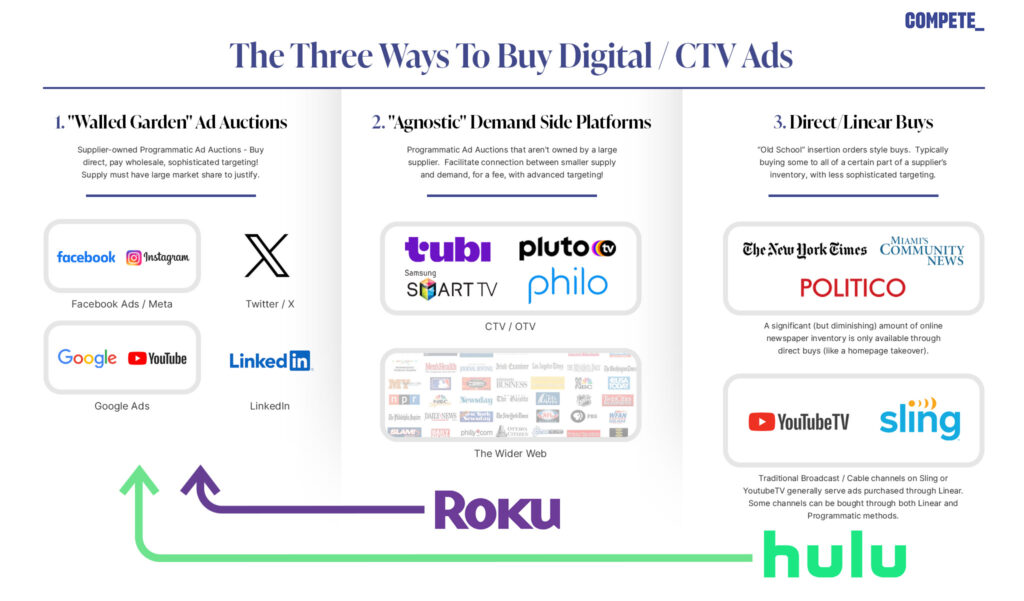

We also want to shed light on the black box of Digital Ad Buying to help you better understand how Hulu and Roku’s new platforms fit into the general trend of media moving towards Programmatic Auctions. Central to understanding this trend is knowing the 3 basic ways Digital and CTV inventory can be bought:

Effectively buying Digital and CTV requires purchasing ads in a lot of different places. The supply and demand of hundreds for thousands of websites and streaming content providers is knit together through an unholy mishmash of ad auctions owned and operated by different entities. However, the actual mechanics of buying the media fall into three basic methods: Direct Buys, “Agnostic” Demand Side Platforms, and “Walled Garden” Ad Auctions.

Starting from right to left, here is a summary of the 3 buying methods:

Direct

The old school “insertion order” style of buying ads still holds domain over a significant but dwindling amount of inventory that many would classify as “Digital.” Many online newspapers still sell a lot of their inventory through this method, especially premium inventory like Home Page Takeovers.

Additionally, folks watching Cable or Broadcast TV channels on Streaming applications are mostly seeing ads bought through Linear. This is how Hulu operated in 2022 – you needed a minimum of $10k to reserve inventory, and would interact with a Hulu sales rep to get the media placed. The new Hulu ads manager (currently morphing into Disney Campaign Manager) enables smaller budgets and more targeted campaigns access to inventory that was previously unavailable with the Direct buy system.

“Agnostic” Demand Side Platforms

The vast majority of websites, such as the Weather Channel or RealGM, and smaller CTV channels, such as Philo and Pluto, are not big enough to justify building their own ad platforms. Advertisers can get their ads placed into such supply by utilizing “Agnostic” Demand Side Platforms, abbreviated as DSPs. DSPs are advertising platforms that knit together the hundreds of thousands of suppliers into an ad platform through which advertisers can target their audiences across the Wider Web and Connected TV. Some of the larger DSP brands are The Trade Desk, StackAdapt, and Basis. They are called “Agnostic” because (ideally) they do not own any of the supply they are facilitating, so they shouldn’t favor certain brands over others in their Programmatic Ad Auctions. Because they are agnostic, they (should) play the role of impartial broker between supply and demand – for a fee, of course.

DSP fees range from as much as 30% for “Managed Service” – where the DSP’s service team place the ads in their platform for the buyer – to as low as 12% for “Self-Service” platform access. Self-Service is when advertisers get access to the DSP’s platform and navigate their auctions/tech to place the ads themselves. Because Self-Service engagements make it so DSPs do not need to provide (and pay for) the human talent necessary to launch campaigns, and because they know they must compete on price to win the partnership of knowledgeable advertising agencies, the markup is much lower for Self-Service than Managed Service. 12-14% is the typical range we see for the lowest rate the DSPs will negotiate for their fee with a Self-Service political advertiser, and they typically only offer that rate if you commit millions of dollars of advertising budget to them over the course of a cycle.

Some DSPs will not directly answer the question “How does your fee structure work,” and instead engage in a bunch of performative hand waving and jargon spewing in an attempt to dance around the question. We do not work with these DSPs (and you probably shouldn’t either).

One of the great benefits DSPs provide to political advertisers is the ability to utilize 1:1 targeting. That means advertisers can use the voter file or influencer data to increase the likelihood each ad that is served is seen by a member of the target audience. Generally, 1:1 targeting incurs a small fee from the DSP and the data partner providing the data (such as Targetsmart, L2, and Catalist), but the increased targeting accuracy makes this a cost that is well worth paying.

Until recently, Roku’s inventory was purchased entirely through DSPs. While some Roku inventory is still purchasable through a DSP, most of Roku’s supply is now only available through Roku’s “Walled Garden” Ad Auction.

“Walled Garden” Ad Auctions

Finally, we come to the type of Digital and CTV media buying where the supplier has enough market share to make their inventory available through their own proprietary ad auctions, often called “Walled Gardens.” Although advertisers can use a DSP to purchase into many of the “supplier-owned” ad auctions, we don’t recommend it, as

- You must pay the DSP their 12-30% mark-up, whereas buying directly within the supplier-owned ad auction incurs no such additional fee

- You generally have worse targeting options and overall control buying through a DSP than what you can do within the walled gardens themselves

- Political advertisers have to worry about getting political ad certifications for platforms like Facebook Ads and Google Ads, which happens within their walled garden. Because of this, there is no getting around dealing with these ad platforms directly

For these reasons, we prefer to buy “wholesale” from the Walled Garden ad platforms ourselves. It is more work than doing everything “the easy way” through a DSP, but it leads to more cost efficient, targeted, and effective campaigns for our clients.

For more info on pricing and important trends in “Walled Garden” and “DSP” inventory, check out our newsletter from January.

The Macro Trend of Media Buying Moving Towards Programmatic Auctions

It is an advantage for a supplier to

- Control their own ad auction, as they can make more $$$ by cutting middle-man entities like a DSP out

- Offer better targeting options, as they will attract advertisers who are looking for the minimum amount of spill to maximize the impact of their clients’ ad dollars

So, the supply of all media has been moving at a rapidly increasing rate from right to left in the graphic below towards Programmatic Ad Auctions.

This trend has resulted in “Digital” ad buying skills:

- Navigating these real-time programmatic auctions to get ads in front of the target audience with the highest accuracy at the lowest cost

- Being able to craft strategically sound programs that incorporate every auction and piece of supply together in a maximally impactful plan

Becoming more valuable to advertisers looking to maximize the impact of their client’s media budgets, both in the political space and in the marketing sector at-large.

Advertising spots as bespoke as United Airlines’ seatback video ads will soon be able to utilize customer data to target audiences 1:1… which sounds incredibly annoying to me but hey, I don’t make the rules.

In fact, there are basically no rules. Some regulation in the space would be nice – but don’t hold your breath it will come anytime soon.

At some point in the near future, we may see the Linear buying model become more or less obsolete. Disney and Roku creating these new ad platforms is just another piece of evidence that this is the way the media buying world is moving.

What Happened to the Hulu and Roku Tactical Capabilities Breakdown?

- There is less Hulu / Roku inventory on DSPs than there used to be. Both companies are now keeping some to most of their inventory for purchase exclusively through their own auctions, leaving less available through Demand Side Platforms. Specifically, we have seen 1:1 targeting on Hulu dwindle to essentially zero over the past few years. If you are a political campaign that wants to effectively reach voters on Hulu and Roku, you need a buyer who has been in the Beta products getting familiar with the new ad platforms.

- Start earlier than you would with other TV-style media buys. Don’t wait too long to get your campaigns rolling on these platforms, especially if you are working with a smaller target audience / district. A lot of our partners and clients assume that CTV platforms can get ramped up at the same breakneck speed as Cable or Broadcast Linear buys, where you can put an order in and often be up and running the next day at full blast. That is not the case with these ad platforms – both can take a few business days to get up to speed from the first ad being served. They have technical hurdles, stemming from their Beta product status, as well as extra hoops that you have to jump through as a political advertising entity.

- Build in time for approval processes. Adding to the expected time lag to launch – Hulu and Roku have variable approval times that aren’t entirely predictable. Roku typically can get up in a single business day, but things seem to halt entirely over the weekend, so don’t expect ads launched Friday to be approved until Monday. Hulu, as a Disney subsidiary, has a lot of extra “brand safety” procedural steps a new advertiser must go through to get live. Hulu first needs to approve your brand, then a single piece of content, before ads start to serve. It can take a couple of business days before you are fully launched, unless you are working with a Hulu rep to expedite the process.

- Their media forecasting is not very accurate. Don’t rely on Hulu and Roku’s in-platform estimates for what you can spend in a given campaign – they almost always seem to inflate those numbers. Roku will accept literally any budget – you could load $1 million into a one-day campaign in a single zip code, and it wouldn’t give you a warning that Roku can’t fulfill that (at least at the time of this writing). Hulu will at least warn you if they think your budget is too big, but they still seem to constantly underspend their forecasts. You should be prepared for any budget forecast for these platforms to be off, and ready to move excess budget to other platforms if necessary.

- Know the video specs. The video ads for Hulu and Roku must be in a unique format. The standard giant file size TV ad format is often too big, but the 1080p standard Digital ad size is often too small. Here are the spec pages for creative on each platform:

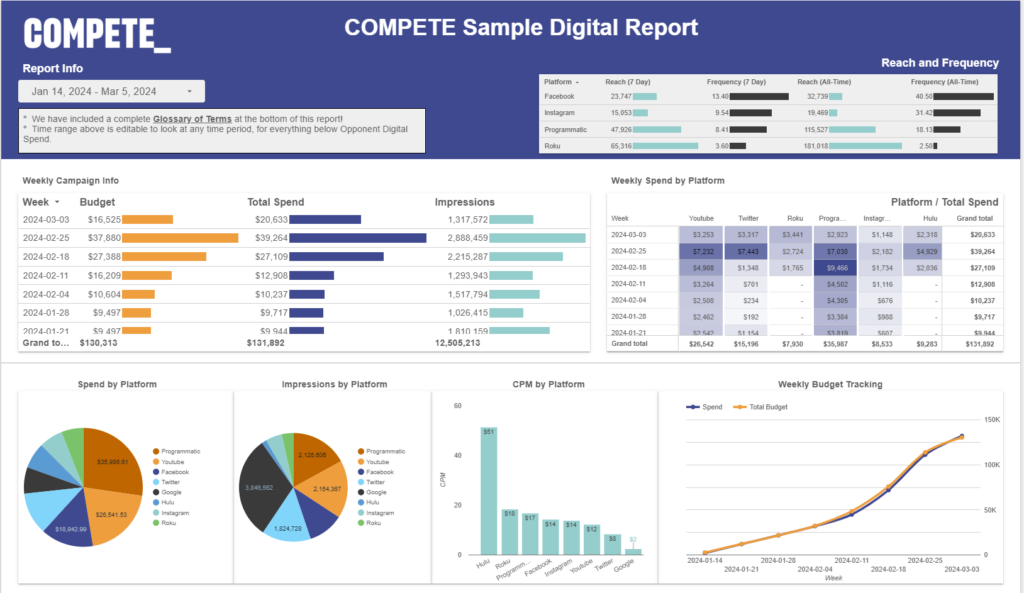

- Expect reporting issues. Both are very new self-serve platforms that are undergoing constant change. As a result, incorporating Hulu and Roku data in holistic cross-platform reports is difficult. For example, Hulu does not currently offer the ability to report on the performance of different pieces of Creative for a particular campaign separately. Having a buying partner like COMPETE who is experienced in working through the reporting issues makes a huge difference. We are constantly having to fix little issues with Hulu and Roku getting incorporated into our reporting dashboards.

Now for some individual platform-specific info!

Roku Learnings

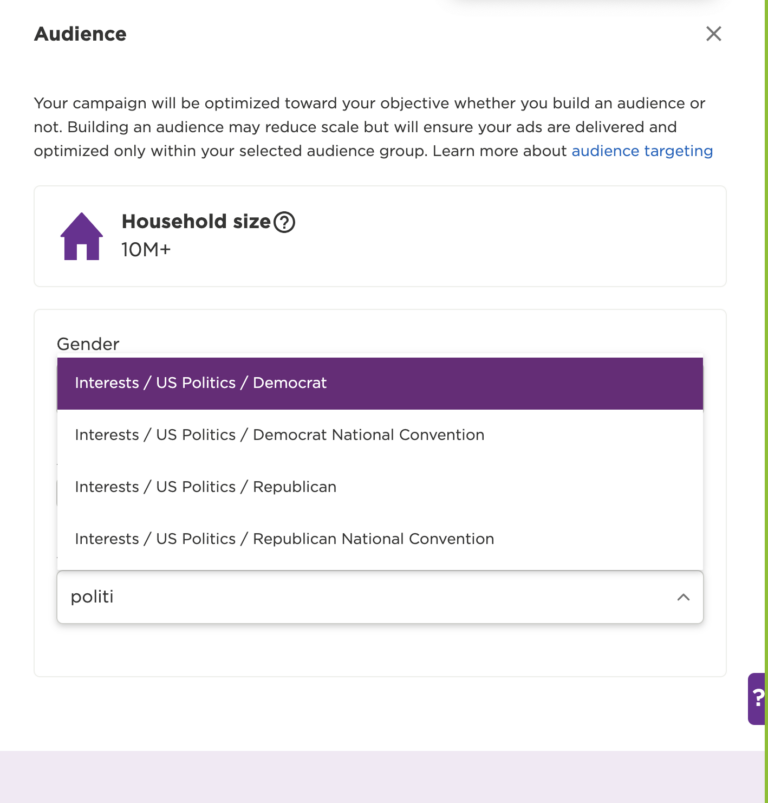

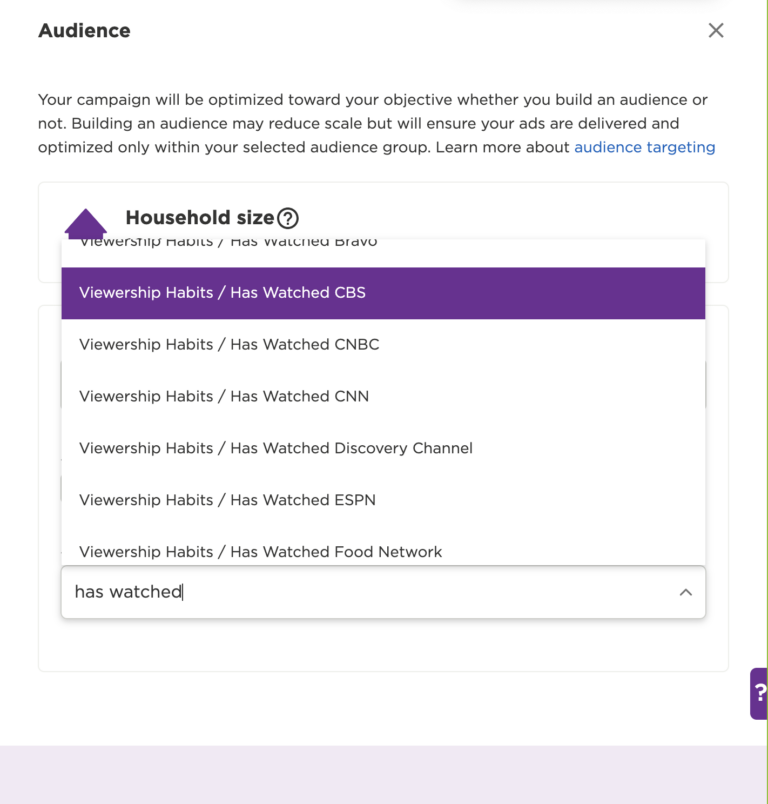

The most striking thing we’ve noticed about Roku is how cheap their CTV ads are. We are seeing most Roku campaigns come in at an $18-30 CPM for the same quality of CTV inventory that costs $55-90 on other channels. Although you can’t 1:1 target on Roku ads manager, it does offer fairly strong “Dynamic” or “Contextual” targeting capabilities. In addition to being able to target Congressional Districts, DMA’s, and zips (leading to way less spill than Cable or Broadcast!), you can target folks based on Political party interest:

Or, you can target audience members through the previous channels they have watched:

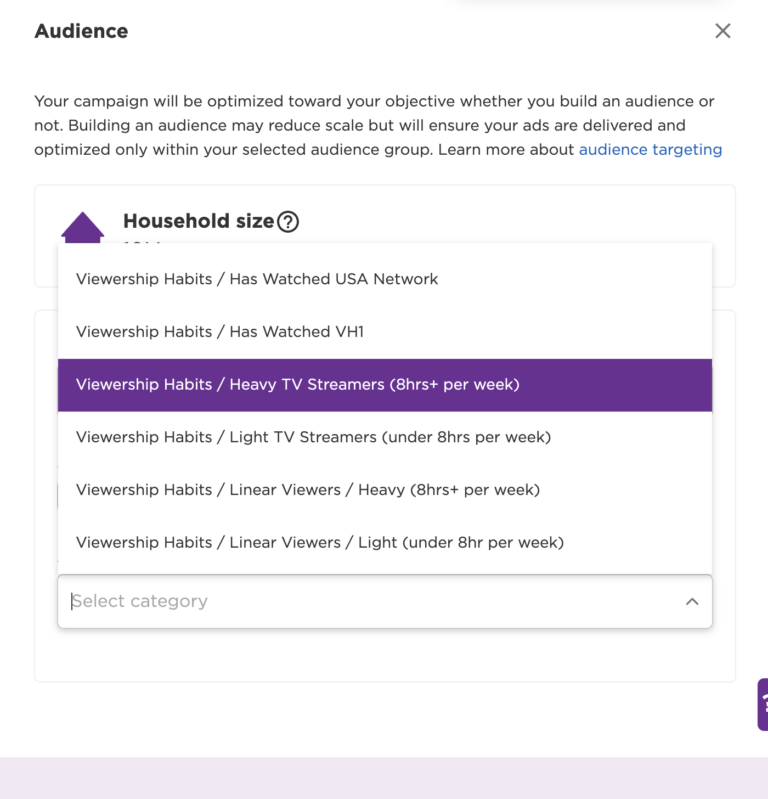

Or how often they watch Roku content:

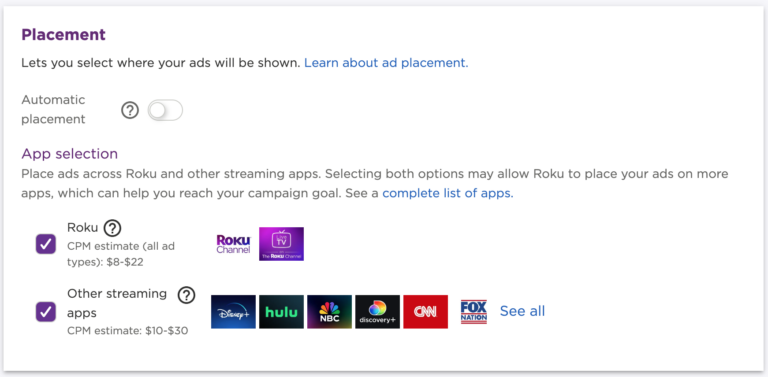

Advertisers can also purchase ads directly onto live TV providers – such as NBC News Now, Accuweather, USA Today, NBC Sports, movie channels, and more – through the Roku ads manager. And, there are hundreds of “live tv” channels that are available through different aggregators like Sling, Antenna, or Satellite TV.

Although you can’t choose to advertise on a specific Streaming app being watched through a Roku device, you can choose to include all of them in your campaign. This enables Roku’s reach to become the 12 million households number they claim as their current reach in America.

Here’s a link to all the different streaming apps you can advertise on through Roku Ads Manager. Note that not all inventory on the other streaming apps can be bought through Roku Ads Manager.

Thanks to Roku Ads’ cheap cost per unit, strong reach, and targeting capabilities, it has started commanding more ad dollars from us.

Hulu Learnings

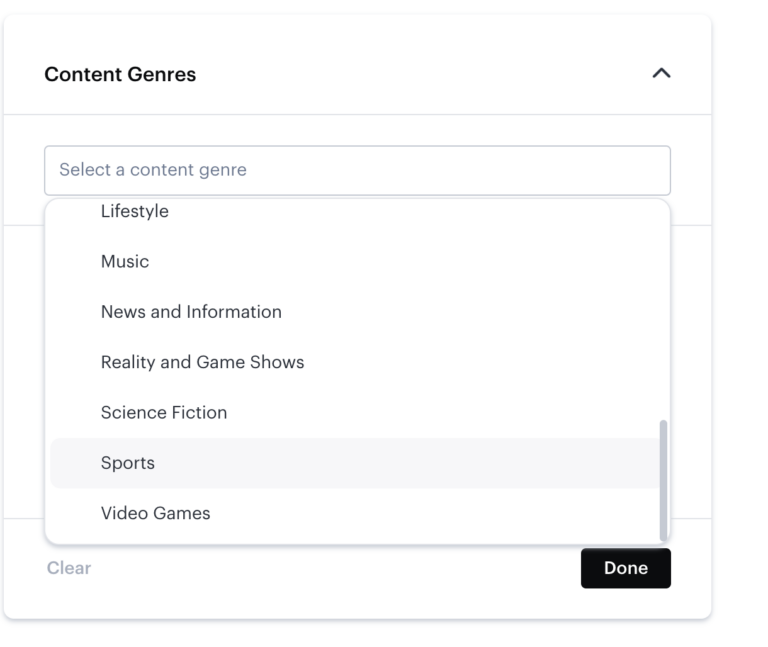

As mentioned earlier, Hulu Ads manager is morphing into Disney Ads Manager. It is very much a work in progress where the status quo may change quickly. Currently, however, Hulu’s targeting capabilities are not nearly as robust as Roku’s for political advertisers, for whom they restrict targeting capabilities down to more or less:

- Geos: Zip, city, state, or DMA’s (still less spill than Cable or Broadcast!)

And

- “Content Genres:” You can choose to target folks who consume particular styles of content, such as “News and Information,” but cannot target specific News and Information content sources, such as “CNN,” “Fox News,” “Left-of-Center News,” “Right-of-Center News,” etc.

That’s about it for political targeting options on Hulu, unfortunately. Another strike against Hulu is that its inventory typically costs around $70 CPM. That’s right – Hulu currently offers both worse targeting and a worse price than Roku, resulting in Hulu commanding a smaller % of budgets than Roku for our average program.

Time is running out to harness these new platforms for the 2024 General Election.

With the election less than 5 months away (gulp), it is important for political advertisers and their clients to be prepared to put these two new ad platforms into the mix. If you’d like to learn more about how COMPETE is approaching incorporating Hulu and Roku’s new tools into what we do, feel free to reach out to me at the email below. Thanks for reading.