Have you noticed that there seem to be more sales reps, from more companies, trouncing around at conferences or introducing themselves in your inbox, all claiming to offer the latest and greatest way to get media to market in the rapidly evolving advertising landscape? We at COMPETE certainly have – and, admittedly, are guilty of it ourselves. You’ve got DSPs, SSPs, OEMs, Publishers, and agencies like us, all in the mix trying to make the case that you should let them steward your ad dollars. It’s no secret why. As linear media gives up market share, the number of eyeballs on, and ad dollars for, streaming TV and Digital-style advertising increases. Participants from across the ecosystem are incentivized to invest more in sales and marketing to battle for the growing pie. For our political market sector in particular, where the amount of money flowing into paid communications is increasing at a higher rate than just about any other vertical, salivary glands are working extra hard. It’s a free-for-all fight for ad dollars in an exploding market.

We’re also seeing market leaders in one part of the ecosystem trying to cut out other members of the ecosystem so they can make more money (see: The Trade Desk, the leading Demand Side Platform, rolling out their own Supply Side Platform). Or, that same market leader making so much money from what they do that others are trying to undercut them to grab some of their market share (see: also The Trade Desk, getting flak for their rather large “Take Rate”, aka the % of revenue rolling through their Demand Side Platform that they pocket for their services). Or, data companies deciding that they want more of the action, so maybe they should be Demand Side Platforms too (here’s looking at you, our eyebrow-raising friends at Targetsmart). Members of the Supply and Demand ecosystem are not playing nice with each other like they used to, blending the lines on who does what in the mad dash for more cash.

We’re Here to Help You Keep Everything Straight

All the change and competition are making it difficult to keep up. In this article, we’ll break down the acronym soup of options for buying New Media, what we see as the positives and negatives of the various options, and why COMPETE takes the approach we do.

If you’re looking for a TLDR: There are many, many ways to purchase the same ad impression. As a strategic and tactical partner for deploying New Media, it’s COMPETE’s job to first evaluate all of the options, and then to execute the most efficient and effective way to buy those ad impressions. We work hard to be the kind of experts our clients can trust. Generally, we take an auction-first, wholesale approach, which we broke down in more detail in this article from last year. We start layering more direct forms of buying on top of auctions when:

- Total dollars per target audience member go up and we anticipate the auctions will be stretched to deliver in full.

- When there is premium inventory that is only available through insertion order style purchases (Like Youtube Select 30s Non-Skippable last year, although Google has started to give us access to this inventory in the Google Ads auction for larger clients this year).

- Our clients have a strategic reason for locking in inventory early (say, the election will be extremely competitive and our clients have the cash to commit early).

We also believe that, as non-biased arbiters of all of the hoopla the various entities are selling, agencies like us play an important role in the ecosystem. All of the players claim to have the best targeting capabilities (now complete with a throwaway reference to whatever AI they claim to be integrating), the most fantastic inventory you can only get exclusively through them, and pricing that can’t be beat. The expert New Media agency like COMPETE must sift through all of the pitches to come up with the best mix for our clients.

You can trust us to navigate the landscape and pick and execute the right options to give your campaign the best chance to win – that’s our job!

Breaking Down the Acronym Soup

Let’s get into how the ecosystem fits together and who all the players are.

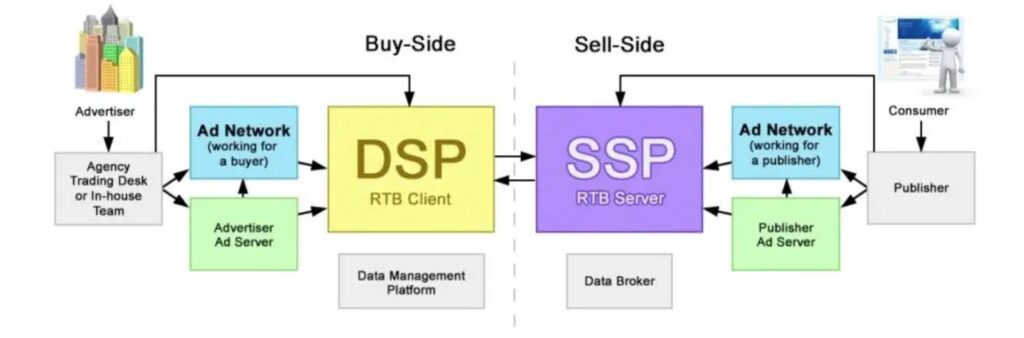

DSPs, short for “Demand Side Platforms,” are advertising technologies that connect advertisers with multiple suppliers to deliver media. They offer a range of targeting capabilities (including integrations with data providers like VAN, Targetsmart, and L2), pricing and service options, and technical prowess. We broke down Demand Side Platforms in more detail last year here.

DSPs interact with SSPs, short for “Supply Side Platforms,” to get the media to market.

SSPs are advertising technologies used by publishers to connect their inventory to demand. Within the main Agnostic DSP COMPETE sits on, Basis, we have access to 49 separate SSPs, which in aggregate provide access to thousands of publishers. SSPs are also sometimes called “Exchanges” because they offer advertisers the ability to buy media on open auctions. Advertisers place bids for particular target audiences and media placements, entering into a real-time auction against every other advertiser bidding for that particular mix of audience and placements. Media is then sold to the highest bidder (with some caveats we won’t get into here – here’s looking at you Hal Varian, the legendary creator of “Quality Score”) as part of the “Demand Waterfall” process (the Demand Waterfall is a whole different can of worms that we won’t get into detail in this article, but you can learn more about here).

The real-time auction bidding that the DSP / SSP interaction enables gives sophisticated advertisers a ton of control over deploying media. COMPETE utilizes these auctions in a variety of ways to provide value for our clients – get lower prices, deploy media campaigns quickly, reach targets across a vast array of publishers / suppliers, etc. However, there are a couple of downsides to buying all media through open exchanges:

- Many publishers hold some of their premium supply back from the open auctions, so they can sell them at higher prices for guaranteed revenue.

- Oftentimes, in competitive campaigns with well-heeled advertisers bidding for the same target audience, there isn’t enough media available on the auctions to fully deliver a budget.

For these reasons, DSPs also offer advertisers access to PMPs, short for Private Marketplace Deals. These are direct deals with publishers for access to premium inventory that still can be bought within the Demand Side Platform, but will have a higher bid floor than what you can expect to get in the SSP open auctions, guaranteeing the publishers more cash for their choice inventory. When you pay a higher price for media through a PMP, you’ll have priority access to the publisher’s inventory, ahead of the open auctions of the SSPs. Thousands of PMPs are automatically available through the premier DSPs. Oftentimes, you must also work out deals directly with publishers for them to be available in a DSP. For example, to get access to more of their premium inventory, COMPETE has worked out custom PMP deals with Paramount and NBC Universal, which we can now utilize within our DSP to buy more media from these publishers.

Is your head spinning from all of the acronyms yet?

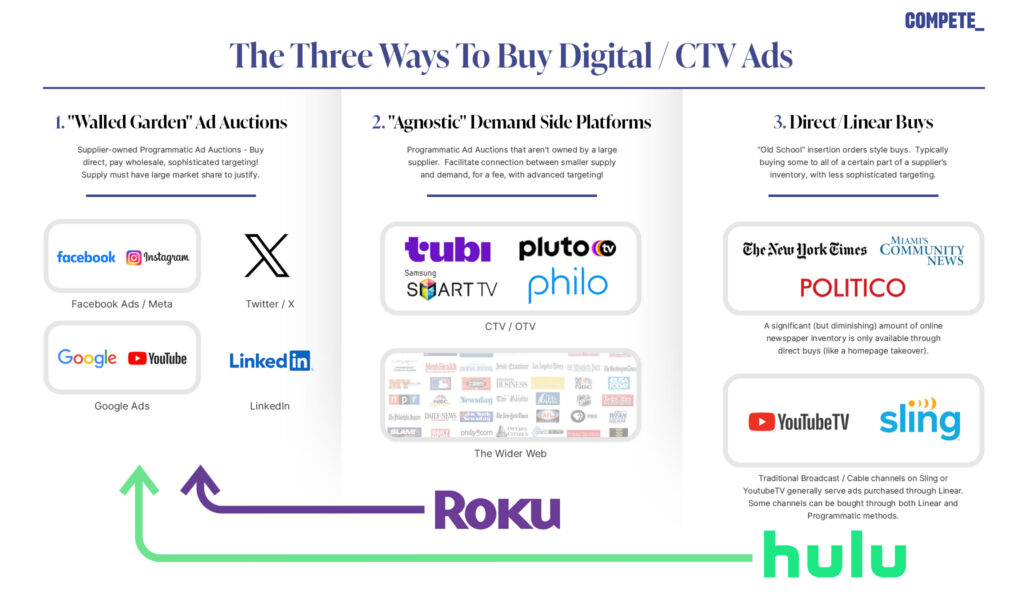

Some DSPs are also SSPs, in that they control/own both the ad platform and supply of the inventory available in the ad platform. For example, all of the “Walled Gardens” – where you must buy Facebook, Instagram, Youtube, and other market share leaders. – are both DSPs and SSPs. We broke down Walled Gardens in more detail in that same article from last year.

Confusingly, SSP is also the acronym for “Self-Service Platform,” another term firmly entrenched within the world of buying media programmatically. DSPs offer both “Managed Service,” where you ship them all the money and they place the buy for you, and access to their “Self-Service Platform,” where an agency’s buyers get to put “hands on keyboard” and navigate the DSP’s back-end tech to place the media themselves. COMPETE almost exclusively prefers using Self-Service Platforms to place media, as we believe the increased control gives our talented team the ability to deploy media more efficiently for our clients (not to mention that DSPs often charge significantly more for Managed Service than what you’ll pay them through use of their Self-Service Platform).

Neither the Supply Side Platform exchanges or PMPs guarantee an advertiser access to all of a publisher’s premium inventory. To do that, you need to engage in an insertion order style buy, shipping money to the suppliers directly for a fixed price, in a similar manner to how linear media is bought and sold. In this process, you forego all of the benefits of participating in the auctions, losing a lot of control. In exchange, you get to lock down the guaranteed premium inventory. Some publishers only make their media available through direct buys, although that is becoming less common.

You can also reserve premium inventory through your DSP utilizing what’s called a “Programmatic Market Guaranteed” deal (PMG), although you will pay your DSP a fee for doing this. You may be better served shipping the money directly to the publisher to get a better wholesale price by cutting out the DSP (at COMPETE, we try to take a wholesale “cut out the middle man” approach whenever possible, so as to get our clients the best price).

When you ask publishers how much of their inventory is available through exchanges and PMPs, versus how much you can only get through Direct insertion order style buys / PMGs, you typically don’t get a straight answer. After all, they are incentivized to want you to send them guaranteed money, up front, at higher prices. But in our experience, outside of the most competitive campaigns, you can get access to plenty of inventory to reach saturation goals through the auctions. “Between the exchanges and PMPs, advertisers have access to the vast majority of inventory in the market,” said a seasoned DSP expert whom we spoke with when writing this article.

To complicate matters further, we must consider the blurring of lines between the players in the ecosystem that we mentioned at the top of this article. When the Trade Desk announced that they were building their own SSP, all of the leading SSPs freaked out, as the implication of the Trade Desk’s decision is that SSPs are going to get cut out. Some have responded in kind by creating their own DSPs (Xandr and OpenX are two examples of this). The Supply / Demand delineation is not as clean as it was a few years ago.

On top of all of this, in the past couple of years, we’ve seen an entirely new player entering the market – the Original Equipment Manufacturers (OEMs).

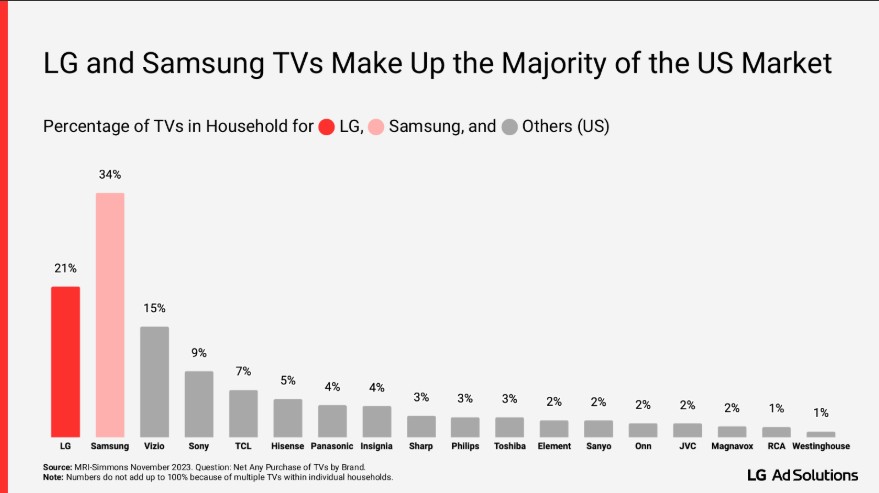

For our purposes, OEMs are the companies that build the physical hardware through which the whole advertising system occurs – folks like Samsung and LG, who make Smart TVs, or folks like Roku, who make the streaming players. Apparently, they’ve been looking at all the advertising cash changing hands that is enabled by their hardware, and have decided they want in. Advertisers can now send money directly to the OEMs, and they will place media through their Smart TVs and Streaming Players directly (kind of).

We spoke with Keith Norman, VP of Political Sales at LG, about the benefits of utilizing OEMs more directly in the buying process. We found three points of his compelling:

- OEMs offer substantial market share – the graph below breaks down American Household Smart TV use by company:

- OEMs have unique access to data on users of their hardware across many CTV suppliers. “We own the glass,” Keith said. “We know the viewer better than anyone – what they are watching, what they are not watching.” This allows them to offer Automatic Content Recognition Data (abbreviated ACR – did you think we had run out of acronyms?), which Keith says gives advertisers deeper insight into user behavior that will enhance targeting.

- OEMs offer some unique inventory opportunities for well-heeled campaigns. For example, you can buy the LG TV home screen on a zip-to-zip basis, which we found to be an interesting “home page takeover” style application of their supply.

One challenge with OEMs (other than Roku) in our mind – they don’t currently offer their own ad auctions / Self-Service platforms. To buy directly from LG, we have to ship the money to Keith and his team, reducing our control over the efficiency of the buy. Until this changes, our approach to the OEMs will likely remain similar to how we approach premium publishers – make sure we have access to as much of their inventory as possible through PMPs and SSPs on our DSPs, and when budgets get big for competitive campaigns, consider direct deals with the OEMs to lock down their premium inventory in advance.

If you’ve made it this far, we hope you have a better understanding of who all the players are across the Supply / Demand ecosystem that you may be hearing more from as they embark on the eternal quest for more ad revenue. We also hope you have a better appreciation for New Media buying agencies like COMPETE, who have to stay on top of all of this in our eternal quest to help our clients win by getting their media to market in the most efficient and effective manner.

And, of course, we hope you have a belly full of delicious acronym soup. Yum yum.

If you’d like to learn more about our approach to navigating the New Media landscape, don’t hesitate to reach out to me at the info below.

Zach Mandelblatt

President

Zach@CompeteEverywhere.com