The 2022 General Election defied conventional wisdom in many ways, including bucking some expectations for Digital ad pricing. Several factors pulled ad pricing in different directions. On one hand, political advertisers have started to value Digital as a Persuasion tool more highly and have spent more of their budgets on Digital than in past elections. On the other hand, we were entering a period of economic uncertainty with advertisers across all verticals decreasing their budgets and social platforms like Meta hemorrhaging stock prices. The rise of ads-based streaming TV providers also impacted the Digital arena. And, on top of everything else, rampant inflation made price predictions even more volatile than usual.

Amid the chaos, there is a lot to learn from the Digital landscape of 2022. To help left-of-center campaigns and causes more wisely deploy their Digital budgets, we want to share data and analysis from the hundreds of campaigns we’ve worked on the past couple of years. Let’s dig in.

Here are our main takeaways:

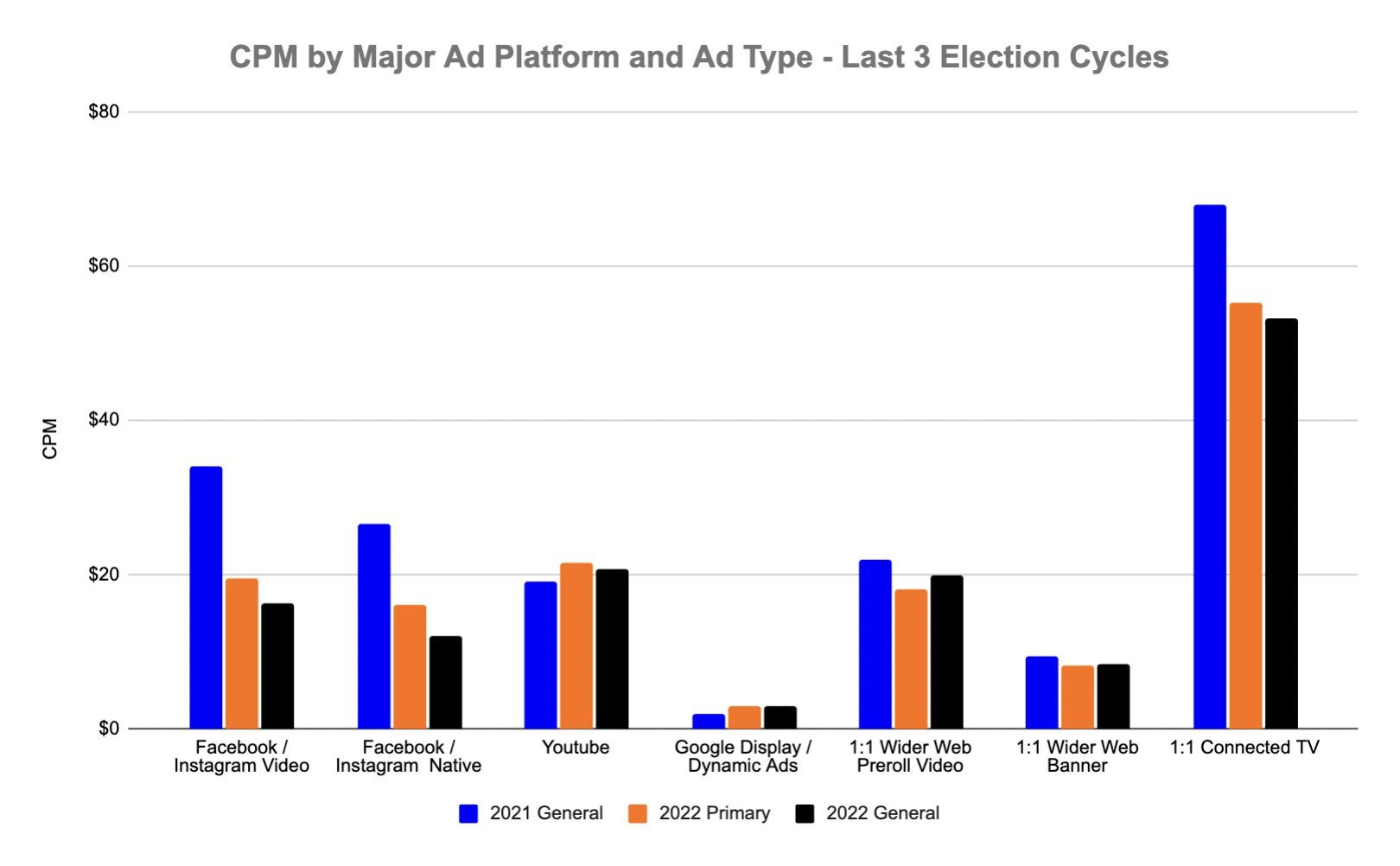

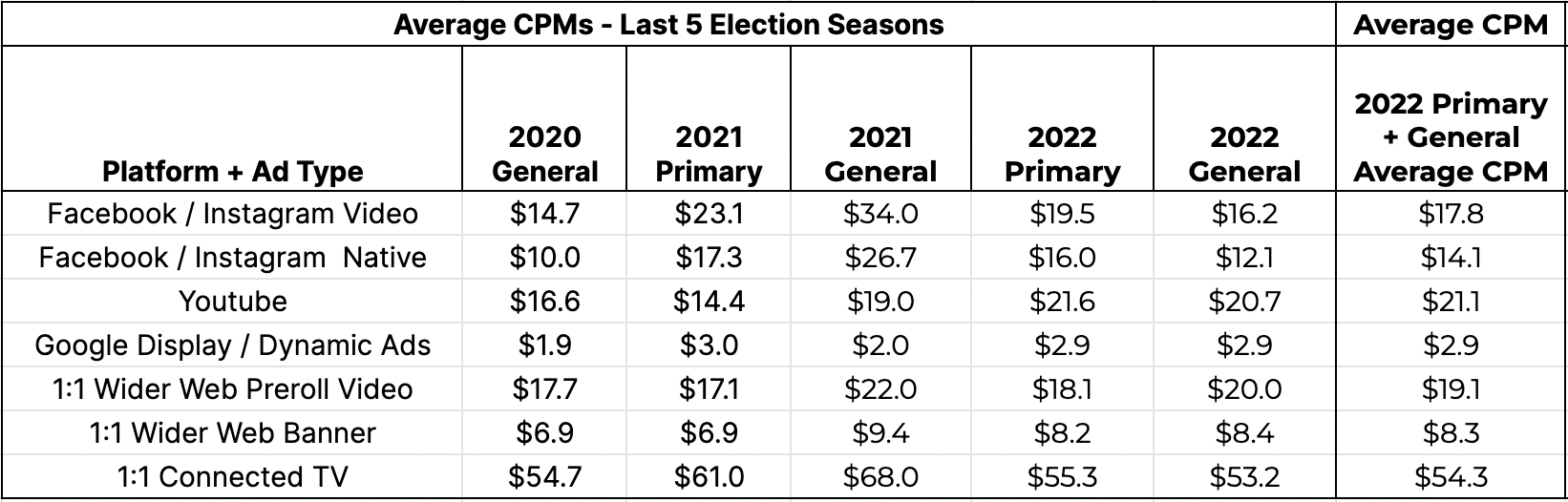

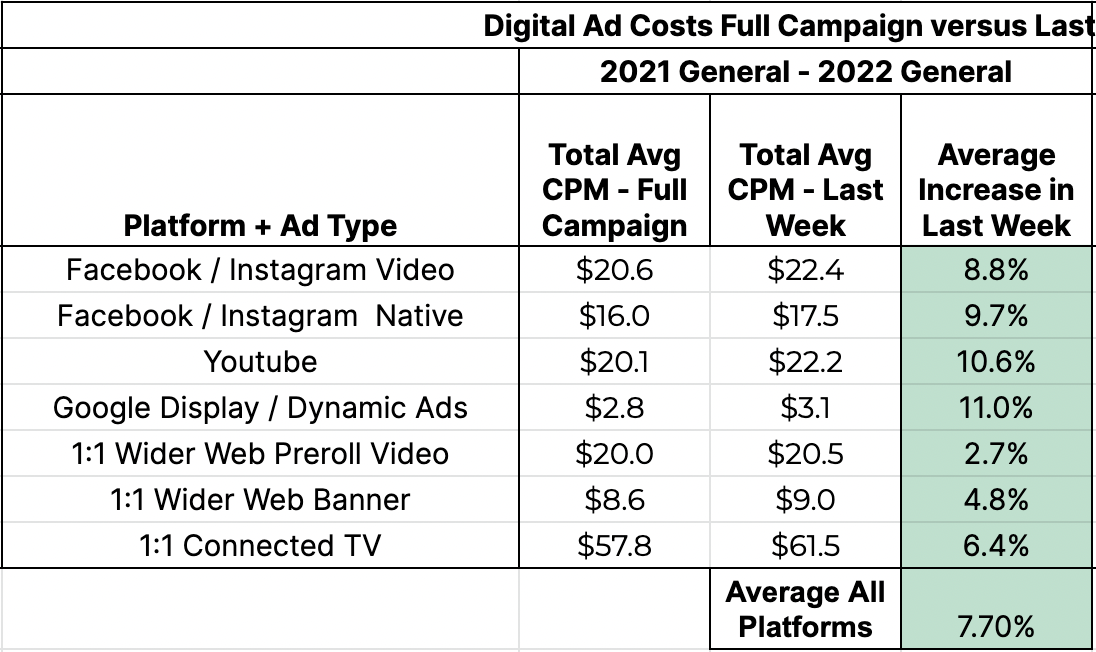

- Costs were down across the board. In the 2022 General Election cycle, buying ads on every platform except for Youtube and Google Display was significantly cheaper than it was in the 2021 General Election cycle. In addition, the average CPM (cost per 1,000 impressions) was lower for every platform other than 1:1 Wider Web PreRoll Video and Banner than it was in the 2022 Primary. Facebook and Instagram as well as 1:1 Connected TV saw significant drops in prices since 2021. We expected costs to increase in the General Election as more advertisers competed for Digital inventory, so we were pleasantly surprised to have earned more impressions for our clients within their budgets.

- Facebook, Instagram, and 1:1 CTV are the drivers of this year’s price drop.

- When broken down by platform, we can see that CPMs for Facebook and Instagram decreased by more than 50% from the 2021 General to 2022. We believe that the price drop is a result of Meta’s questionable business direction choices and Apple’s iPhone privacy policies driving away many non-political advertisers. The good news for political advertisers is that the Meta platforms’ ability to target using voter data, or other consumer data, has remained unchanged. Therefore, these market driven price drops have made Facebook and Instagram a better buy for political advertisers than they have been in previous election cycles. We haven’t seen a significant drop in target audience use of these platforms – total reach seems to be about the same as it was in the past. Overall, Mark Zuckerberg’s loss is our gain. Huzzah!

- 1:1 CTV costs decreased by about 20% from 2021 to 2022 as more streaming television providers have started offering 1:1 targeting capabilities, increasing total supply. More and more providers that offer free content in exchange for ads have become significant players in the market in the last year or two (for example, Philo, Pluto, and Tubi). We expect CPMs to continue to decrease as these suppliers grab more market share and other suppliers begin to offer better targeting options.

- One interesting theory we have been noodling about that our data set supports: The lower the median income of a political campaign’s target audience, the MORE advertisers can spend on 1:1 target Connected TV. This also makes sense intuitively: We find that the biggest suppliers of 1:1 targeted CTV are the “Content for ads” providers like Philo, Pluto, Tubi, and Samsung TV. More well-to-do voters who can afford premium content provider subscriptions like HBO Max and Disney+ are less likely to use these free streaming services. This is a trend we are going to continue to monitor.

- Prices for the rest of our Primary Digital Platforms remained relatively stable. 1:1 Wider Web PreRoll went up about 10% from the General to the Primary – your guess is as good as ours as to why that would be (could be a quirk of our data set). For suppliers not in total freefall (like Meta), or who were undergoing huge changes in supply (1:1 CTV), the market forces pulling prices in opposite directions seemed to have largely canceled each other out.

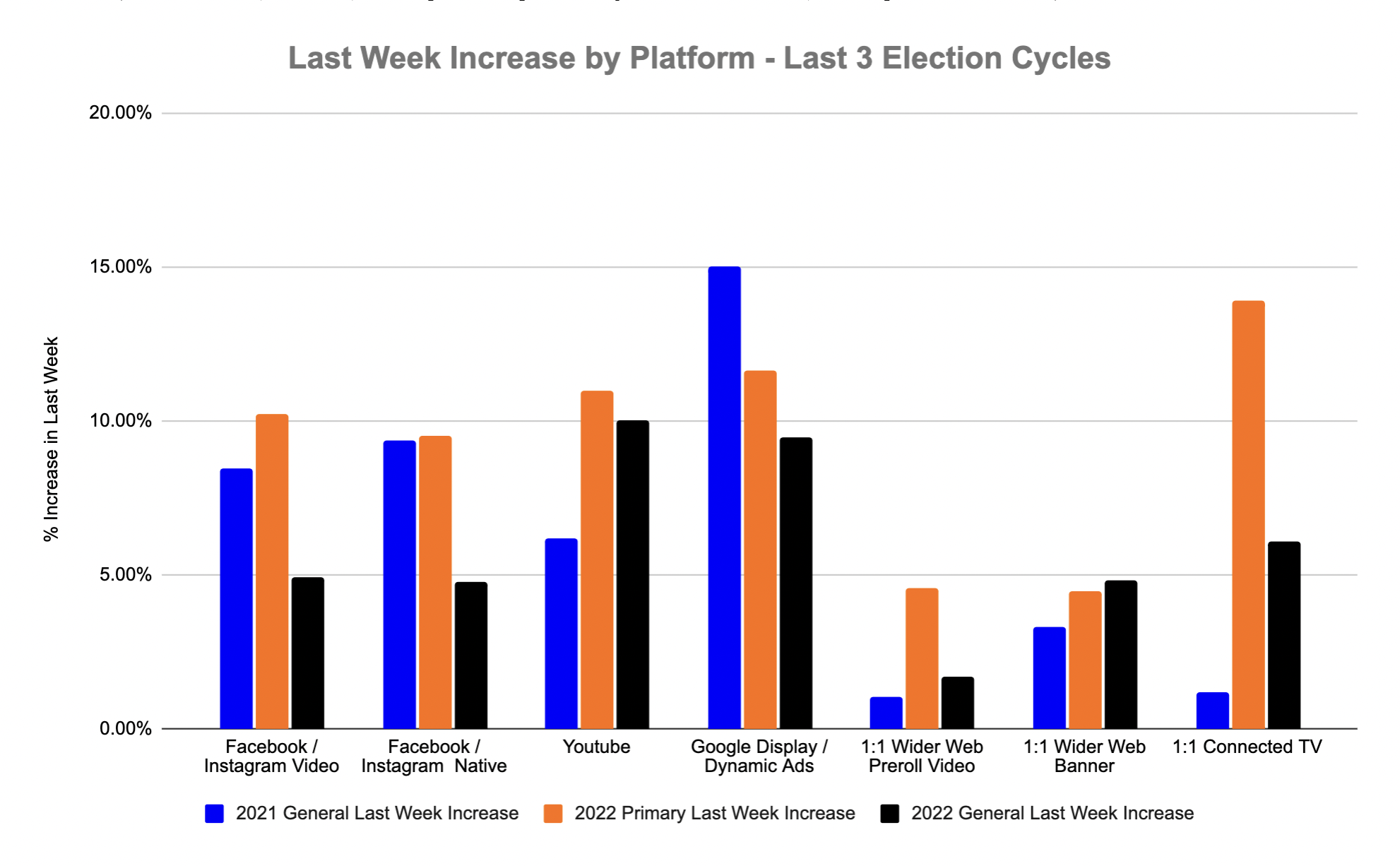

- Price changes in the last week of the election: Cost increases in the last week of the 2022 General were more modest than cost increases in the 2022 Primary and the 2021 General. Costs typically increase in the last week of an election as campaigns ramp up to spend their full budget and outside groups often jump into a race and make bidding more competitive.

- In the last week of the 2022 General Election, CPMs increased by an average of 5.97% across platforms. In comparison, both the 2021 General and the 2022 Primary saw more significant cost increases, at 6.36% and a whopping 9.34% respectively. This complements our finding that Digital advertising was cheaper overall in the 2022 General Election than other recent elections.

- Negative advertisements cost more than positive advertisements. The average CPM for a negative or contrast message was $16.80, whereas the average CPM for a positive or introductory message was $11.53. While negative messaging can be an important tool for campaigns, it is less cost effective for campaigns with limited budgets.

If you’re interested in reading analysis we’ve done on previous election price changes, check out:

Our Mid-2022 Update

Our Mid-2021 Update

We’re proud to help our campaigns and partners maximize the impact of their Digital advertising using campaign expertise, Digital best practices, and transparent pricing. The steady decrease of average CPMs both validates our Digital strategy and signals the increasing advertising potential of these platforms. Lower costs per 1,000 impressions mean that more people see your ads for the same price, so you get more bang for your buck. If you have any questions about our data or why we think it is so important for campaigns, causes, and the consultants we work with to better understand Digital ad pricing, don’t hesitate to reach out to us.

Zach Mandelblatt

President

Zach@CompeteEverywhere.com

503-819-6778

Hannah Frater

Digital Ad Tech Extraordinaire

Hannah@CompeteEverywhere.com

347-819-3252